Did Elon Musk Buy Ford Motor Company? The Definitive Answer

Short answer: No. Elon Musk did not buy Ford Motor Company. Ford stays an independent, publicly traded automaker with strong family control. Keep reading to learn why the rumor pops up, who owns Ford, how Tesla fits in, and what this means for the EV market. I will give you clear facts in plain English. I will also show you how to spot real news from noise.

Table of Contents

- Summary: Why this story matters

- What is the short answer to “Has Elon Musk bought Ford?”

- Who owns Ford Motor Company today?

- Why do Elon Musk Ford acquisition rumors start?

- How big would a Ford buyout be?

- What is Ford’s plan for the future?

- What is Tesla doing under Elon Musk?

- Are Ford and Tesla rivals, partners, or both?

- Side by side facts: Ford vs Tesla

- Could Elon Musk buy Ford in the future?

- How do market news and filings prove or disprove big deals?

- What does this mean for EV buyers, drivers, and builders?

- How do we tell rumor from fact online?

- Conclusion: Two strong paths in one changing auto world

- References

- Key takeaways

Summary: Why this story matters

Rumors move fast in the automotive industry. They jump from post to post. You want simple truth. I hear that. The question “did Elon Musk buy Ford Motor” keeps popping up because the EV market changes fast, and big names like Elon Musk sit in the middle of it.

Problem: News noise spreads fast.

Agitate: Bad info wastes time and money. It can even shake the stock market.

Solution: Use facts, filings, and clear checks. I will walk you through them.

What is the short answer to “Has Elon Musk bought Ford?”

No. Elon Musk did not buy Ford Motor Company. There is no regulatory filing, no Board of Directors vote, and no official press release from Ford or Tesla, Inc. to say so. There is no Bloomberg report or Wall Street Journal front page saying it happened.

I track business news closely. A deal this big would hit the New York Stock Exchange (NYSE) feed at once. It would land in the S&P 500 news stack. It would appear in Investor relations pages for both firms. It did not. So the answer is no.

Who owns Ford Motor Company today?

Ford Motor Company trades on the NYSE under “F.” It is a public company with many shareholders. The Ford family still has strong voting control through special Class B shares. Bill Ford Jr. serves as Executive Chair. Jim Farley serves as CEO. A family legacy runs deep. Think Henry Ford and the long line of leaders behind the blue oval.

Ford also works with the Ford Foundation on social good. The company keeps Board of Directors oversight and keeps a clear shareholder structure. You can review its CFO and CEO leadership in its Investor relations page and SEC filings. No part of that framework says Elon Musk owns Ford.

Why do Elon Musk Ford acquisition rumors start?

Three reasons spark this talk.

First, Elon Musk’s high profile. He leads Tesla, Inc. and runs other ventures like SpaceX, Neuralink, The Boring Company, and X Corp. (formerly Twitter). He posts fast and bold. People guess his next move.

Second, market dynamics & EV competition. Tesla’s EV strategy moves fast. Ford’s EV strategy moves fast too. Many people see Ford vs. General Motors, Tesla vs. legacy automakers, and Ford vs Tesla sales as a horse race. That heat makes fans ask wild “what if” questions.

Third, online chatter & misinformation. A random post can claim “Tesla acquiring Ford” or “Has Elon Musk bought Ford” with no proof. A meme says “Is Ford for sale?” and it spreads. That is noise. Real deals leave real trails.

How big would a Ford buyout be?

Huge. You look at market capitalization to size a deal. Ford market capitalization changes day by day. It often sits in the tens of billions. Tesla market capitalization runs much higher, and it also swings. Any full buyout of Ford would take a massive pile of money, months of legal work, and broad government regulations review. It would impact the automotive industry, the stock market, and even the supply chain for manufacturing plants.

A move like this would trigger global headlines across the EV market, autonomous driving watchers, and battery technology analysts. Banks would chew on Mergers & Acquisitions (M&A) math for months. You would see every major outlet, from Bloomberg to Wall Street Journal, cover it wall to wall.

What is Ford’s plan for the future?

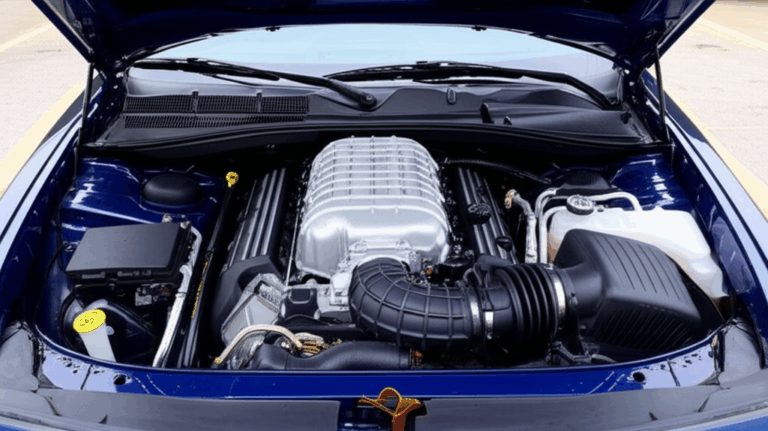

Ford follows the “Ford+” plan. It set up three units. Ford Blue for internal combustion engine (ICE) vehicles. Ford Model e for EVs like Mustang Mach-E and F-150 Lightning. Ford Pro for trucks and vans for work like E-Transit. Jim Farley says the goal is smart growth with a focus on the bottom line.

Ford leads in trucks and SUVs. It builds strong in Dearborn, Michigan and around the world. It targets a bigger share of the electric truck market and the electric SUV market. It pushes charging infrastructure partnerships and better battery technology. It keeps a steady hand in commercial vehicles and in high volume lines.

What is Tesla doing under Elon Musk?

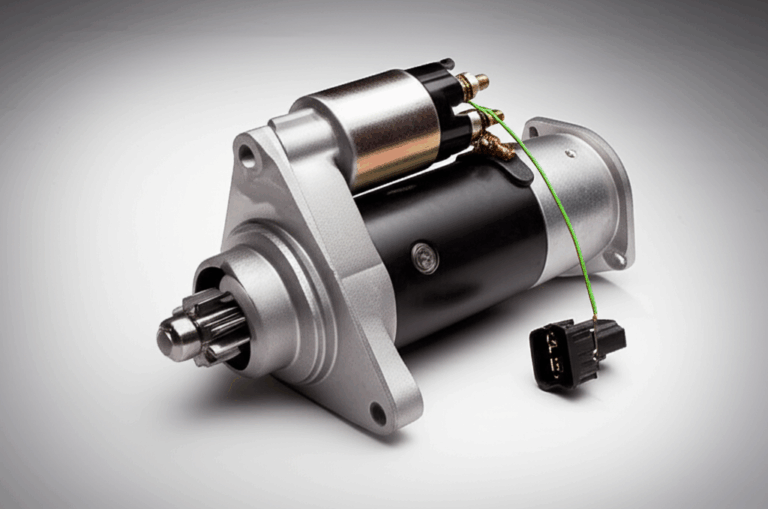

Elon Musk leads Tesla, Inc. from Austin, Texas at the Gigafactory. The company scales Model 3, Model Y, Model S, Model X, and now Cybertruck. Tesla’s strategy focuses on organic growth, vertical integration, and software. They push Full Self-Driving research, AI, robotics like Optimus, and energy storage. This is Tesla innovation in action.

Tesla stock price can swing when Musk talks. Elon Musk net worth also swings with NASDAQ trading. That is how the stock market works. Yet the plan stays simple. Build more cars. Cut cost per unit. Improve software. Keep leading in the EV market.

Are Ford and Tesla rivals, partners, or both?

Both. We see Ford vs Tesla sales in EVs. We see head-to-head matchups like Ford F-150 Lightning vs Tesla Cybertruck and Ford Mustang Mach-E vs Tesla Model Y. They fight for mind share and market share. That is real.

At the same time, the auto world sometimes partners on charging infrastructure or safety groups. Automakers often share standards with Volkswagen, Toyota, General Motors, Stellantis, Rivian, and Lucid Motors in the mix. These firms all live in the same automotive industry. They face the same government regulations, the same chip crunch, and the same supply chain headaches. Rivalry does not mean buyout.

Side by side facts: Ford vs Tesla

Here is a simple view of where both companies stand. These numbers often change, and they vary by source. Treat them as broad guideposts.

| Feature/Metric | Ford Motor Company | Tesla, Inc. |

|---|---|---|

| CEO | Jim Farley | Elon Musk |

| Headquarters | Dearborn, Michigan, USA | Austin, Texas, USA |

| Founded | 1903 (by Henry Ford) | 2003 (co-founded by Martin Eberhard & Marc Tarpenning, led by Musk since 2008) |

| Primary Focus | Legacy automaker moving to EVs, trucks, SUVs, ICE and EV | EVs, energy storage, AI, robotics |

| Current Market Cap (approx.) | Often in the tens of billions | Often in the hundreds of billions |

| Ownership Structure | Public (NYSE: F). Ford family has strong voting control via Class B shares. Bill Ford Jr. is Executive Chair. | Public (NASDAQ: TSLA). Elon Musk is the largest individual shareholder. |

| 2023 Vehicle Sales (Global) | Around 4+ million units across lines | Around 1.8 million EV deliveries |

| EV Models | Mustang Mach-E, F-150 Lightning, E-Transit | Model 3, Model Y, Model S, Model X, Cybertruck |

| Recent Strategic Focus | “Ford+” plan, separate units, focus on profit per unit and EV ramp | Scale production, FSD, AI, energy, robotics |

| Acquisition History | Bought and later sold Volvo Cars, Land Rover, Jaguar | No big auto acquisitions. Focus on organic growth. |

These facts do not show a buyout. They show two strong firms with different paths.

Could Elon Musk buy Ford in the future?

You can ask “Can Elon Musk buy Ford?” in theory. A billionaire can make offers. A board can listen. Billionaires buying companies happens. Yet it takes math, law, and time. Institutional ownership Ford and Ford family ownership matter. Voting rights matter. Shareholder structure Ford would make a hostile deal hard. The Ford family trust and Class B shares give the family strong voice.

There is also the question of fit. Elon Musk’s vision for auto industry sits inside Tesla’s mission statement. Tesla valuation ties to that vision. Buying Ford could distract from Elon Musk’s future plans for Tesla. Tesla’s expansion strategy is organic. It avoids giant takeovers of other automakers. So the odds look low.

How do market news and filings prove or disprove big deals?

Look for hard proof. You need:

- A clear public statement from the buyer and the target.

- Regulatory filings that show the terms.

- A board vote from each company’s Board of Directors.

- Coverage by top outlets like Bloomberg and Wall Street Journal.

- A trail on Investor relations pages for both companies.

If you do not see these, you likely face stock market rumors or online chatter. Major Mergers & Acquisitions (M&A) also face government regulations review. They must pass tests for competition and fairness.

What does this mean for EV buyers, drivers, and builders?

If you shop for EVs, focus on cars that fit your life. Want a truck that hauls and tows? Check F-150 Lightning and Cybertruck. Want a family crossover? Compare Mustang Mach-E and Model Y. Look at range, price, charging speed, and safety. Watch Ford stock price and Tesla stock price if you invest, but do not let rumor drive your cart.

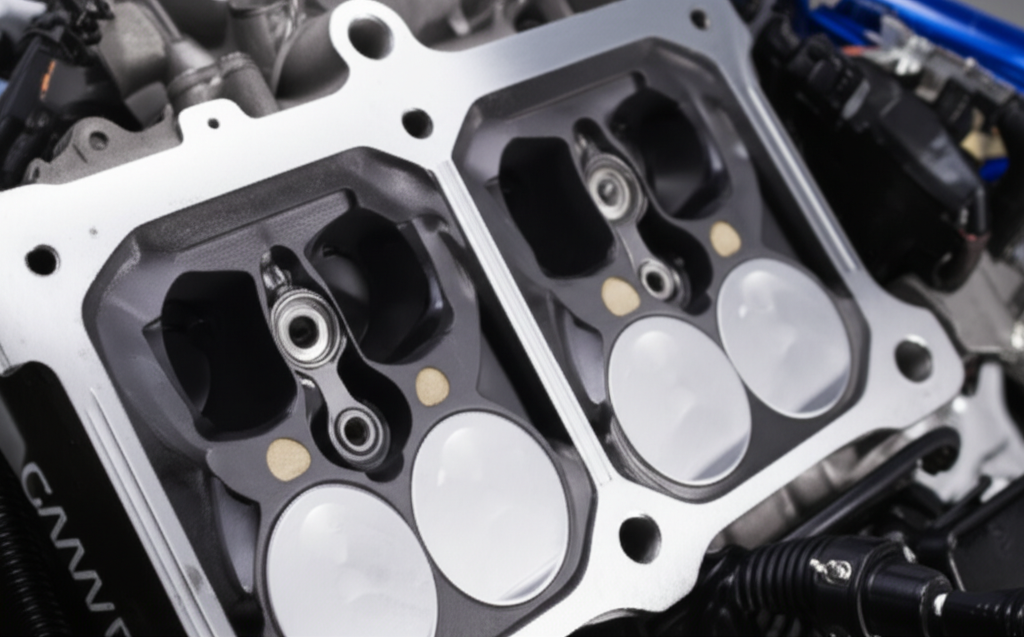

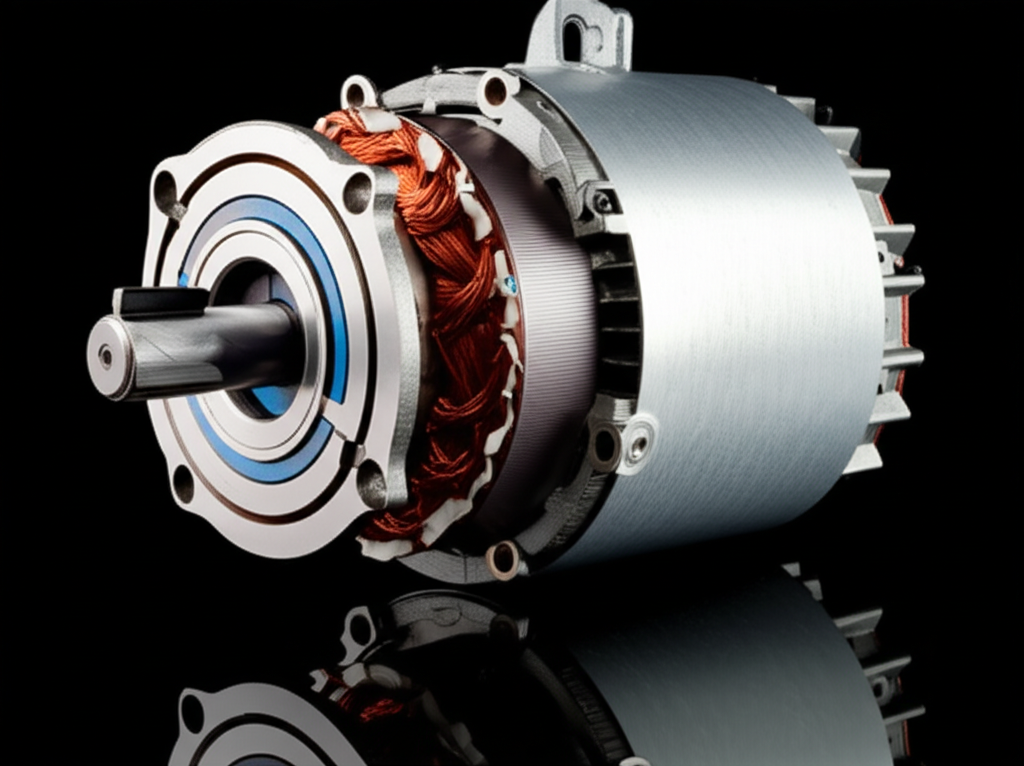

If you build or maintain EV systems, small parts make a big difference. Motor core laminations shape motor performance. High quality materials cut loss and heat. They boost range and power. Learn how the stator and rotor work together to make torque and motion with this simple guide: understand stator and rotor basics.

For better motor design, the stator core lamination stack and the rotor core lamination design matter. Good steel matters too. If you work in motors or power, explore these resources:

- Improve motor efficiency with premium stator core lamination

- Build strong torque with precise rotor core lamination

- Cut core loss using clean electrical steel laminations

Problem: Poor core parts waste power.

Agitate: Your motor runs hot. Range drops. Cost per mile rises.

Solution: Use tight core lamination stacks, better grade steel, and proven suppliers, and your system runs cooler and longer.

How do we tell rumor from fact online?

Here is a simple filter you can use any time someone says “Elon Musk bought Ford” or “Tesla acquiring Ford” or any wild claim like “Is Tesla buying other companies?”

- Check the source. Is it a person with no link, or a real report from Bloomberg or Wall Street Journal?

- Check company sites. Does Ford Motor Company or Tesla, Inc. post it under Investor relations?

- Check filings. Big deals show up fast in SEC filings and stock exchange notices on NYSE and NASDAQ.

- Check if the story cites market capitalization, shareholder structure, or any numbers you can verify.

- Beware hostile takeover auto industry talk with no detail. Real deals have numbers, terms, and a timeline.

If you cannot track it to paper, you likely face a rumor. This is how we avoid false automotive industry news and keep our heads clear.

Deep dive: Competition, not acquisition

Let’s compare Ford vs. Tesla where it counts.

- EVs head to head. Mustang Mach-E vs Tesla Model Y. F-150 Lightning vs Tesla Cybertruck. You can test drive both and pick what feels right.

- Manufacturing. Tesla innovation uses big casting and vertical integration. Ford innovation uses a blended model across legacy lines and new EV lines.

- Sales and service. Tesla sells direct. Ford uses dealers. Two distinct business models with pluses and minuses.

- Global reach. Ford’s global presence runs deep in trucks and work vans. Tesla’s global presence grows around new Gigafactory sites.

The race is tight. That is good for you. Better cars. Better prices. Faster upgrades.

The people and places behind the logos

Names matter. Elon Musk leads Tesla. Jim Farley leads Ford. Bill Ford Jr. guides the board at Ford. Sites matter too. Ford has roots in Dearborn, Michigan. Tesla builds fast in Austin, Texas and beyond. Both watch battery technology, autonomous driving, and charging infrastructure like hawks.

Rivals stand all around. General Motors pushes Ultium. Volkswagen scales MEB. Toyota balances hybrids and EVs. Stellantis brings global brands. Upstarts Rivian and Lucid Motors chase premium EV buyers. These players shape the automotive industry outlook for the next decade.

Money talk: Ownership and valuation

Investors watch Ford valuation and Tesla valuation. They compare institutional ownership Ford with institutional ownership Tesla. They ask “Who are major Ford shareholders?” and “Who are major Tesla shareholders?” They study Ford dividend and Tesla profitability. They read Ford Motor Company stock analysis and Tesla Inc. stock analysis to make picks.

This is smart. Know what you own. Know what you plan to own. Yet remember this. A rumor like “Elon Musk’s stake in Ford” with no filing is not a fact. A tweet with no backup is just a tweet. Let data speak.

A quick word on motors and materials

You cannot run EVs without good motors. You cannot build motors without iron materials. That is why engineers care about silicon steel laminations, CRGO lamination core, and CRNGO lamination grades. They study EI core and UI lamination core for power devices. They tune heat, noise, and loss. They pick the right transformer lamination core for charging and power units. In short, materials shape performance at the heart of every car.

If you want a simple primer on how motors work and where they fail, these intros help:

- Learn the basics of the motor core laminations that drive efficiency

- Learn how to spot a motor problem before it becomes a breakdown

Problem: A small materials miss can wreck range.

Agitate: Your EV loses miles. Your charger runs hot. Your costs climb.

Solution: Use proven laminations and test early. It saves time and cash.

What about Elon Musk’s other ventures?

Some folks ask, “If Musk runs SpaceX, Neuralink, and X Corp. (formerly Twitter), would he even want Ford?” He already has a full plate. His company portfolio is wide. He focuses on Tesla’s mission statement and Elon Musk’s vision for energy. Buying Ford would split focus. That does not fit Tesla’s expansion strategy of organic growth.

Fans watch Elon Musk Twitter posts for hints. Traders watch Tesla stock news. Auto buffs watch Ford stock news. That is fine. Just remember the rule. Big news needs big proof.

Is Ford struggling or strong?

You might ask, “Is Ford struggling?” Ford has ups and downs like all big firms. It works on Ford financial health each quarter. It invests more in EVs. It balances ICE and EV lines. It aims for profit per unit, not just volume. The brand stays strong. Ford’s brand value shows deep trust in trucks. The Ford future plans aim to keep that lead while growing EVs.

On the Tesla side, “Is Tesla buying other companies?” Not really. It prefers to build in-house. It hires and scales. It locks in materials. It grows its own manufacturing plants. It targets margins with software and energy products.

How to read the tea leaves without getting burned

If you want to stay ahead on automotive industry trends and industry consolidation, do this:

- Track official news rooms and Investor relations.

- Watch earnings calls with the CEO and CFO.

- Compare market capitalization across peers.

- Follow the EV market share mix across segments.

- Read trade press and trusted sources.

This keeps you sharp. You will spot real moves before the rumor mill even spins.

Conclusion: Two strong paths in one changing auto world

Here is the bottom line. Ford did not get bought by Elon Musk. Ford Motor Company remains independent with strong Ford family control through Class B shares. Tesla stays focused on its own lane, its technology, and its factories. Both shape the road ahead. They compete hard in the electric vehicle competition. They also push the whole market forward.

So do not let clickbait drive your view. Let facts drive it. That is how smart buyers, smart investors, and smart builders win.

References

- Ford Motor Company Investor Relations, annual and quarterly reports

- Tesla, Inc. Investor Relations, annual and quarterly reports

- New York Stock Exchange and NASDAQ company listings and notices

- Bloomberg, company news coverage

- Wall Street Journal, company news coverage

Key takeaways

- No, Elon Musk did not buy Ford Motor Company.

- Ford is a public company on the NYSE with Ford family voting control via Class B shares.

- A deal this big would show up in official filings, press releases, and top-tier news.

- Ford and Tesla are rivals in EVs, not in an acquisition.

- Tesla grows by building, not by buying giant automakers.

- Check sources and filings to separate fact from rumor.

- EV buyers should compare real models like F-150 Lightning vs Cybertruck and Mach-E vs Model Y.

- Engineers can boost EV performance with better laminations and motor design basics.

- Watch market capitalization, leadership, and strategy to see where each company goes next.

- Use the PAS lens. Spot the problem. Feel the pain. Pick the solution that fits your needs.