Ford Motor Company (F) Dividend Schedule: Dates, History, and How to Get Paid

Table of contents

- Introduction: Why I Track Ford’s Dividend Calendar

- Quick Answer: When Does Ford Pay Dividends?

- The Four Dividend Dates You Must Know

- Declaration date

- Ex-dividend date

- Record date

- Payment date

- Recent Ford (F) Dividend Announcements and Example Dates

- Ford’s Dividend History: What I’ve Learned From the Ups and Downs

- How to Receive Ford Dividends (Step-by-Step)

- Buying F before the ex-dividend date

- Payment methods and timing

- Using a DRIP to reinvest

- What Influences Ford’s Dividend Policy

- Profitability, free cash flow, and payout ratio

- Capital allocation and EV investments

- The Board of Directors and broader auto cycle

- Is Ford a Good Dividend Stock for You?

- Yield vs safety

- Comparing Ford to peers

- How I balance income with risk

- Practical Strategies: How I Track the Next Ford Dividend

- FAQs: Fast Answers to Common Ford Dividend Questions

- Conclusion: Stay Ready for Ford’s Next Dividend

Introduction: Why I Track Ford’s Dividend Calendar

I love dividends because they pay me while I sleep. Straightforward cash flow. Ford Motor Company (ticker: F) sits on many dividend investors’ watchlists for one simple reason. It often pays a regular quarterly cash dividend that can deliver a solid yield when the stock trades at value levels. I first bought Ford for income during a cyclical dip. Then I learned the hard way that knowing the ex-dividend date matters more than almost anything else. Buy one day late and you miss the payment. Ouch.

In this guide I’ll walk you through when Ford pays, how the dividend schedule works, and what I look at before I decide whether to buy shares for income. I’ll use simple language and real examples. You’ll see the terms that show up on every “NYSE F dividend” announcement, like declaration date, ex-dividend date, record date, and payment date. I’ll also point you to the best place to confirm the next dates in real time. You will leave with a plan to get paid on time and a better sense of dividend safety and sustainability.

Quick Answer: When Does Ford Pay Dividends?

Here’s the answer most people want first. Ford typically pays a quarterly cash dividend. In my experience the payment date usually lands in early March, early June, early September, and early December. That cadence can shift a little from year to year. It still follows a regular quarterly rhythm. Sometimes the exact ex-dividend date and payment date will slide by a week because of weekends, holidays, or the Board’s timing.

Key takeaway: Ford’s dividend is usually quarterly. The payment dates commonly fall in March, June, September, and December.

To be crystal clear. You must own the stock before the ex-dividend date. If you buy on or after the ex-dividend date you won’t get the upcoming dividend. The record date and payment date follow after that.

The Four Dividend Dates You Must Know

I used to confuse these dates. Then I missed a payment. Now I never mix them up. Here’s how I explain them to friends who ask “When does F pay dividends,” “How to get Ford dividends,” or “What is the Ford dividend record date.”

Declaration date

- What it is: The Board of Directors announces the dividend amount per share and sets the other dates.

- Why it matters: This is when you find out if Ford kept the dividend, raised it, cut it, or declared a special dividend.

Ex-dividend date

- What it is: The cutoff date to buy shares if you want the dividend. Buy before the ex-dividend date. Hold through the open on the ex-dividend date and you’re set.

- Practical note: US markets moved to T+1 settlement in 2024. The ex-dividend date usually falls one business day before the record date.

- Why it matters: This is the most important date for you as a shareholder. Miss it and you miss the next payment.

Record date

- What it is: The date when Ford checks its list of shareholders eligible for the dividend.

- Why it matters: You don’t need to still hold the stock on the record date if you owned it before the ex-dividend date. The system has already “tagged” you as eligible.

Payment date

- What it is: The date Ford actually pays cash to shareholders who qualified.

- Why it matters: That’s the happy day. The money shows up in your brokerage account or bank.

Recent Ford (F) Dividend Announcements and Example Dates

To make this concrete I keep a running “Ford dividend calendar” with the key dates. Here’s a sample of recent cycles that show the usual flow from declaration to payment. Use these as a template for what Ford’s dividend schedule looks like across quarters. Always confirm the next “Ford ex-dividend date,” “record date,” and “payment date” on Ford’s Investor Relations page or your brokerage because dates can change.

Ford Motor Company (F) Recent Dividend History (Example Data; confirm on Ford Investor Relations for real-time accuracy)

| Declaration Date | Ex-Dividend Date | Record Date | Payment Date | Dividend Per Share (DPS) | Dividend Type |

|---|---|---|---|---|---|

| Feb 08, 2024 | Feb 15, 2024 | Feb 16, 2024 | Mar 01, 2024 | $0.15 | Regular Cash |

| Oct 26, 2023 | Nov 16, 2023 | Nov 17, 2023 | Dec 01, 2023 | $0.15 | Regular Cash |

| Jul 27, 2023 | Aug 16, 2023 | Aug 17, 2023 | Sep 01, 2023 | $0.15 | Regular Cash |

| Feb 02, 2023 | Feb 16, 2023 | Feb 17, 2023 | Mar 01, 2023 | $0.15 | Regular Cash |

| Feb 02, 2023 | Feb 16, 2023 | Feb 17, 2023 | Mar 01, 2023 | $0.65 | Special Cash |

| Oct 27, 2022 | Nov 17, 2022 | Nov 18, 2022 | Dec 01, 2022 | $0.15 | Regular Cash |

| Jul 27, 2022 | Aug 18, 2022 | Aug 19, 2022 | Sep 01, 2022 | $0.15 | Regular Cash |

| Jan 13, 2022 | Feb 17, 2022 | Feb 18, 2022 | Mar 01, 2022 | $0.10 | Regular Cash |

| Mar 19, 2020 | (Suspended) | (Suspended) | (Suspended) | $0.00 | Suspension |

| Jan 16, 2020 | Feb 26, 2020 | Feb 27, 2020 | Mar 02, 2020 | $0.15 | Regular Cash |

What stands out:

- Quarterly cadence: You see that March, June, September, and December rhythm around the payment date.

- Regular DPS: $0.10 per share resumed the dividend in 2022 and the regular dividend increased to $0.15 in 2023.

- Special dividend: Ford paid a $0.65 special cash dividend in early 2023. Special dividends happen when the Board chooses to return extra cash outside the regular quarterly payout. They are not guaranteed.

I treat special dividends as a bonus. I never count on them. I plan around the regular Ford quarterly dividend instead.

Ford’s Dividend History: What I’ve Learned From the Ups and Downs

Ford has paid dividends for a long time across more than one auto cycle. It also hit the brakes during the 2020 COVID-19 shock. The company suspended the dividend in March 2020 to conserve cash during a brutal time for the automotive industry. That suspension taught me a hard truth about cyclical businesses. Even iconic companies will protect liquidity when the economy wobbles and supply chains break.

As conditions improved, Ford reinstated its quarterly dividend at $0.10 per share in 2021. In 2023 the Board raised the regular dividend to $0.15. That increase signaled confidence in cash flow and the balance sheet. Ford even issued that $0.65 special dividend in early 2023. You will see those changes reflected in “Ford dividend history,” “Ford dividend track record,” and “Ford dividend yield history” charts on financial sites.

I like to review:

- The Ford dividend payout ratio relative to earnings and free cash flow.

- The Ford dividend yield over time versus peers.

- Any “Ford dividend policy changes” that show up on earnings calls or in press releases.

I follow Ford’s Investor Relations page, quarterly earnings releases, and the 10-Q and 10-K filings for context. The Board of Directors sets the dividend based on a full view of profitability, cash flow, debt, and capital allocation plans. That includes big projects like EV buildouts, battery plants, and software investments. If you follow those, you can often read the tea leaves on the dividend outlook.

How to Receive Ford Dividends (Step-by-Step)

If you want the “Ford upcoming dividends,” here’s the simple checklist I use.

1) Buy shares of Ford (ticker F) in a brokerage account

- Any major broker will do. You can also use a direct stock purchase plan if available. Most of us buy through a brokerage because it’s easier, faster, and cheaper.

- You do not need to tell your broker you want the dividend. If you hold the shares through the ex-dividend date you qualify automatically.

2) Own the shares before the ex-dividend date

- This is the crucial step. Check the “Ford ex-dividend date” each quarter.

- With T+1 settlement you must buy no later than the trading day before the ex-dividend date to get the dividend.

- Example: If the ex-dividend date is Thursday then you must buy by Wednesday to qualify.

3) Hold through the market open on the ex-dividend date

- You can sell the stock on the ex-dividend date and you still receive the dividend. I don’t recommend trading around dividends unless you’re very experienced. Prices often adjust by roughly the dividend amount on the ex-date.

4) Get paid on the payment date

- Most brokers credit dividends to your cash balance on the payment date during business hours. You can take the cash or reinvest.

5) Consider the Dividend Reinvestment Plan (DRIP)

- Many brokers offer a DRIP that takes the cash dividend and buys more F shares automatically. I use this with dividend stocks I want to accumulate over time.

- DRIPs help you compound your income. They also simplify the process because you never have to place a trade manually.

Payment methods and tax notes

- Payment methods: Direct deposit into your brokerage cash balance is standard. Some transfer agents support check or direct deposit to your bank but brokers keep it simple.

- Taxes: Dividends may be qualified or ordinary depending on your situation. I don’t give tax advice. I keep records and talk to a tax pro if I’m unsure. International investors should check with their broker about withholding rates and forms.

What Influences Ford’s Dividend Policy

You can answer “Is Ford’s dividend safe” only if you look under the hood. I focus on four things before I judge “Ford dividend sustainability” and “Ford dividend outlook.”

Profitability, free cash flow, and payout ratio

- Cash is king. The payout ratio tells me how much of earnings or free cash flow goes out as dividends. A lower payout ratio gives the company more room to invest and weather downturns.

- I watch Ford’s quarterly free cash flow, net income, and guidance. I also pay attention to Ford Credit’s results because that arm of the company affects overall cash generation.

Capital allocation and EV investments

- Ford has heavy capital expenditures right now. It’s shifting toward electric vehicles, software, and commercial services. The EV transition needs battery plants, manufacturing lines, and advanced motor technology. That costs money and it affects dividend capacity.

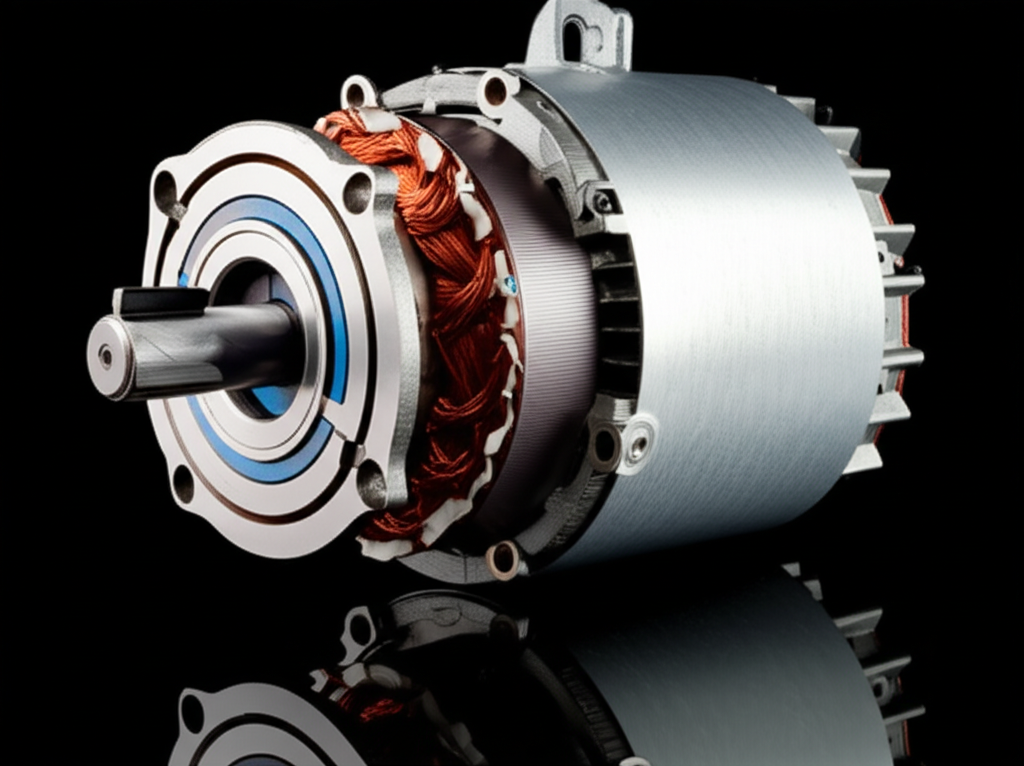

- On the hardware side, EVs rely on components like stators, rotors, and electrical steel. If you want a primer on how those parts work inside an electric motor read this quick guide on the motor principle. It explains how current, magnets, and motion tie together.

- For a visual of the core moving pieces you can skim this overview of the stator and rotor. Ford’s EV investments touch all of this because better motors and batteries improve efficiency and range.

- The raw materials matter too. EV motors use specialized steels that impact cost and performance. If you’re curious, here’s a backgrounder on electrical steel laminations and how they shape motor efficiency. You can also see how a stator core lamination gets built up for the motor’s core. I track these themes because they feed into Ford’s long-term capex and margins which influence dividend decisions.

The Board of Directors and broader auto cycle

- Ultimately Ford’s Board of Directors sets the dividend. They balance investment needs with shareholder returns.

- The auto industry runs on cycles. Supply chains ease and tighten. Pricing power comes and goes. Labor costs move. All of that shows up in cash flow and the payout ratio.

Earnings calls and investor communication

- I listen to Ford’s earnings release and skim the transcript for any “Ford dividend announcement,” “Ford dividend policy,” and “capital allocation” comments. If they signal more cash to growth areas I expect stability in the dividend if free cash flow supports it. If they flag headwinds I prepare for a pause rather than a cut.

Is Ford a Good Dividend Stock for You?

Let’s talk decision making. The “Is Ford a good dividend stock” question depends on your goals. I look at three angles.

Yield vs safety

- Yield: Ford’s dividend yield moves with the stock price. A lower stock price can push the yield higher. That can tempt me to chase yield. I resist that urge. I check why the stock dropped first.

- Safety: I compare the payout ratio against earnings and free cash flow. I also model a margin of safety. If the economy slows do I still see the dividend covered? If the answer is yes I feel better holding for income.

Comparing Ford to peers

- I compare Ford’s dividend yield and payout ratio to other auto names like General Motors or Toyota. Each has a different approach to dividends and buybacks. Some focus more on share repurchases. Others lean on a lower base dividend with special dividends when cash piles up.

- I review “Ford dividend vs competitors,” “dividend yield comparison,” and the “Ford dividend history chart” to see if Ford’s yield compensates me for auto-cycle risk.

How I balance income with risk

- I don’t rely on a single dividend stock for income. I slot Ford into an “income with cyclicality” bucket. I size it accordingly. A stable utility or consumer staples stock will usually get a bigger weight than a cyclical automaker in my income sleeve.

- I plan for bumps in the road. That mindset kept me calm during the 2020 suspension and the 2021–2023 rebuild.

Practical Strategies: How I Track the Next Ford Dividend

Here’s my simple playbook to stay on top of “Ford upcoming dividends,” “Ford dividend dates,” and “Ford dividend payment schedule.”

- Build a quarterly reminder: I put a reminder on my calendar about two weeks before the expected ex-dividend date based on prior quarters. For Ford that often means mid to late February, mid May, mid August, and mid November.

- Use Ford Investor Relations: I confirm the “Ford dividend announcement” and the exact ex-dividend, record, and payment dates as soon as they post. That solves the “Ford dividend date lookup” problem fast.

- Watch earnings releases: The Board often declares the dividend around earnings time. I skim the press release for the dividend per share and the declaration date.

- Set alerts in my brokerage: Most brokers let me add F to a watchlist and set “dividend” or “corporate actions” alerts. Those alerts catch changes to the dividend policy or schedule.

- Keep a personal “dividend calendar 2024 and 2025” sheet: I track the “Ford Q1 dividend,” “Ford Q2 dividend,” “Ford Q3 dividend,” and “Ford Q4 dividend” with ex-dividend dates and payment dates next to them. I do this for all my dividend stocks so I can plan cash flows.

FAQs: Fast Answers to Common Ford Dividend Questions

When does Ford Motor Company pay dividends?

- Ford generally pays a quarterly cash dividend. Payments commonly arrive in March, June, September, and December. Check the latest “Ford dividend calendar” for exact dates.

What is Ford’s ex-dividend date?

- It changes each quarter. The ex-dividend date usually comes one business day before the record date in the US now that markets run on T+1 settlement. You must buy F before the ex-dividend date to get the dividend.

How often does Ford pay dividends?

- Quarterly. That’s the normal frequency in the US and for Ford. Special dividends can happen but they are not regular.

What is Ford’s dividend per share (DPS) right now?

- The regular quarterly dividend has been $0.15 per share in recent periods following an earlier $0.10 reinstatement. Always confirm the current DPS on Ford’s Investor Relations page or your brokerage because the Board can change it.

What about special dividends?

- Ford paid a $0.65 special cash dividend in early 2023. Special dividends are discretionary. I don’t plan my income around them.

How do I qualify for Ford’s next dividend?

- Own shares before the ex-dividend date and hold through the open on that date. The company sets a record date right after. The cash arrives on the payment date.

Where can I find the next Ford dividend?

- Go to Ford’s Investor Relations website. You can also check reliable financial data providers or your broker’s corporate actions page.

What is Ford’s payout ratio?

- It moves with earnings and free cash flow. I check the latest earnings release and investor presentation for a clean look at dividend coverage.

Is Ford’s dividend safe?

- No dividend is 100% safe. Safety depends on profitability, free cash flow, balance sheet strength, and capital needs for EV investments and other projects. I look at those factors each quarter.

Can I reinvest Ford dividends?

- Yes. Many brokers offer a Dividend Reinvestment Plan (DRIP) for F. You can set it to buy more shares automatically with each payment.

What is Ford’s dividend yield?

- The dividend yield is the annual dividend per share divided by the stock price. It changes as the stock moves. I watch yield in context with dividend safety. A very high yield can signal risk.

Does Ford offer a direct stock purchase plan?

- Some investors use transfer agents for direct purchase or DRIP administration. Many simply use a brokerage because it’s easier. Your broker can tell you the available options.

Do international investors receive Ford dividends?

- Yes but there may be withholding taxes depending on your country and tax status. Ask your broker for details and required forms.

Conclusion: Stay Ready for Ford’s Next Dividend

If you remember one thing remember this. Own Ford shares before the ex-dividend date if you want the next payment. That single rule drives the entire “Ford dividend schedule” strategy. The rest is housekeeping. Watch the declaration date, confirm the record date, and mark the payment date on your calendar.

I track Ford’s dividend history because it tells me how the company treats shareholders through good times and bad. I also keep an eye on the payout ratio, cash flow, and big capital projects tied to EV growth. Those decisions shape the “Ford dividend outlook” for years to come.

Here’s my final checklist for you:

- Add F to a watchlist and set dividend alerts.

- Before each quarter ends check Ford’s Investor Relations page for the latest dividend announcement.

- Buy or hold before the ex-dividend date if you want to collect the next payment.

- Consider a DRIP to reinvest if you want long-term compounding.

- Review Ford’s earnings, cash flow, and payout ratio so you know how safe the dividend looks.

Do that and you won’t ask “When does Ford Motor Company pay dividends” again. You’ll already know when and how to get paid.

Key phrases I use when I research Ford dividends:

- Ford dividend payment dates

- Ford quarterly dividend

- Ford ex-dividend date

- Ford record date

- Ford dividend per share

- Ford dividend yield

- Ford payout ratio

- Ford dividend history

- Ford special dividend

- Ford investor relations

- NYSE F dividend

- Ford dividend calendar 2024

- Ford dividend announcement

- Ford dividend schedule

- Ford dividend when paid

- Ford dividend information

- Shareholder dividends F

- Ford dividend outlook and sustainability

- Ford dividend vs competitors

- Ford dividend track record

- Ford dividend payment schedule

- Ford dividend next payment

- Dividend reinvestment plan for Ford

Final note: I don’t rely on guesses. I confirm every upcoming dividend on Ford’s official Investor Relations page or with my broker before I trade. That habit keeps my income plan clean and my expectations realistic.