Is Elon Musk Buying Ford Motor Company? Debunking the Rumor

As someone who’s spent years with a close eye on the automotive industry, I’ve seen my fair share of wild rumors. They come and go like fads. But one piece of speculation just refuses to die down: the idea that Elon Musk is planning to buy Ford Motor Company. I get asked about it constantly, and every time it pops up on social media, my phone buzzes with messages.

So, let’s get right into it and unpack this whole thing. I’m going to walk you through why this rumor exists, why it’s almost certainly not going to happen, and what the real relationship between these two American giants looks like.

Table of Contents

- The Spark of Speculation: Where Did This Idea Come From?

- The Short Answer: No, and Here’s Why

- Understanding the Key Players in the Automotive Arena

- Why an Acquisition is Highly Improbable (and Practically Impossible)

- The Real Relationship Between Tesla and Ford

- Hypothetical Impact: If a Merger Were to Happen (Pure Speculation)

- Conclusion: The Future of the Auto Industry Without a Tesla-Ford Merger

- Frequently Asked Questions (FAQs)

The Spark of Speculation: Where Did This Idea Come From?

Before we dive deep, let’s address the elephant in the room. This isn’t just a random idea someone cooked up. There’s a certain logic, however flawed, to the speculation. On one side, you have Elon Musk, the ultimate disruptor. He’s the man behind Tesla, SpaceX, and now X (formerly Twitter). He makes bold, unpredictable moves, and his vision for transportation is massive.

On the other side, you have Ford Motor Company—a legacy brand, an icon of American manufacturing. Ford is in the middle of a massive, expensive transition to electric vehicles, facing all the challenges that come with shifting a century-old business model.

So, people look at Musk, who wants to accelerate the world’s transition to sustainable energy, and they look at Ford, with its incredible manufacturing scale and beloved brands like the F-150 and Mustang, and they think… “What if?” It’s a fascinating thought experiment. But as I’ve learned time and again, a fascinating idea doesn’t make for a sound business reality.

The direct answer to the question “Is Elon Musk buying Ford?” is a firm no. There is no current deal, no ongoing talks, and no credible evidence to suggest an acquisition is on the horizon. This article is my attempt to explain exactly why that’s the case.

The Short Answer: No, and Here’s Why

Let’s cut right to the chase. If you’re looking for a quick confirmation, here it is: Elon Musk is not buying Ford.

I’ve followed every official announcement, scanned through financial news from sources like Bloomberg and Reuters, and listened to statements from both Ford’s CEO Jim Farley and Elon Musk himself. There’s simply nothing there. The rumor gains traction because it’s a juicy story. It pits the old guard against the new, the legacy automaker against the tech disruptor. It’s the kind of David vs. Goliath story people love, except in this version, people imagine David buying Goliath’s entire operation.

The reality is far more complex and, frankly, far less dramatic. Both companies are on their own distinct paths, and a merger would be less like a strategic masterstroke and more like a chaotic collision of two completely different worlds.

Understanding the Key Players in the Automotive Arena

To really get why this merger is a fantasy, you have to understand the two companies at the heart of it. They aren’t just interchangeable car manufacturers; their DNA, culture, and goals are worlds apart.

Elon Musk & Tesla: The Disruptor’s Vision

I remember when Tesla was just a quirky startup that many legacy automakers dismissed. Now, it’s an absolute powerhouse. Tesla’s business model isn’t just about building cars; it’s about creating an entire ecosystem. They focus on electric vehicles, battery technology, solar energy, and increasingly, artificial intelligence with their Full Self-Driving project.

Elon Musk’s focus is spread thin, but it’s always directed toward a futuristic vision. He’s juggling SpaceX’s mission to Mars, X’s transformation, and Neuralink’s brain-computer interfaces. Tesla is the centerpiece of his plan for sustainable energy, but it’s one piece of a much larger, more complex puzzle. The company’s culture reflects this: it’s agile, software-driven, and notoriously intense. They operate like a Silicon Valley tech company that just happens to build cars.

Ford Motor Company: A Legacy Adapting to the Future

Then there’s Ford. Founded by Henry Ford, this company literally put the world on wheels. It has a deep history, a massive global manufacturing footprint, and an incredibly strong brand, especially in the truck market with the F-150. For decades, I’ve watched Ford navigate industry shifts, economic downturns, and global competition.

Under CEO Jim Farley, Ford is not standing still. They’ve poured billions into their EV strategy, creating the “Model e” division specifically for this purpose. They’ve had real successes with the Mustang Mach-E and the F-150 Lightning, proving they can compete in the electric age. Ford’s leadership is focused on transforming their own legacy from within, not waiting for a buyout. They have a traditional corporate governance structure, a deep relationship with the United Auto Workers (UAW), and a culture built on generations of manufacturing excellence.

Why an Acquisition is Highly Improbable (and Practically Impossible)

When I really dig into the nuts and bolts of a potential deal, the whole idea falls apart pretty quickly. It’s not just a bad idea; in my opinion, it’s nearly impossible for several key reasons.

Financial Scale and Complexity

First, let’s talk money. While Tesla’s market capitalization (its total value on the stock market) is often 10 to 12 times higher than Ford’s, the sheer cost is staggering. Ford’s market cap hovers around $50-$60 billion. While Elon Musk’s net worth is astronomical (around $200 billion), it’s not like he has that money sitting in a bank account. It’s tied up in Tesla stock, SpaceX, and his other ventures.

To buy Ford, he’d have to sell a massive amount of his Tesla stock, which would tank its price and be a logistical nightmare. Alternatively, Tesla could try to acquire Ford using its own stock, but that would massively dilute the value for existing Tesla shareholders. Imagine telling Tesla investors, who bought into a high-growth, high-profit-margin tech company, that they now own a legacy automaker with lower margins and massive pension obligations. It just doesn’t add up.

Strategic & Cultural Mismatch

This is, for me, the biggest deal-breaker. You can’t just smash two companies together and expect it to work.

- Culture: Tesla’s culture is fast-paced, non-unionized, and software-centric. They build Gigafactories from scratch. Ford has a deeply ingrained, unionized workforce with a century of manufacturing tradition. Integrating these two would be like mixing oil and water. The potential for a culture clash and massive labor disputes is off the charts.

- Leadership: Elon Musk has a very hands-on, top-down leadership style. He’s known for making swift, sometimes radical, decisions. Ford has a traditional Board of Directors and a more conventional corporate structure. It’s hard to imagine these two systems coexisting.

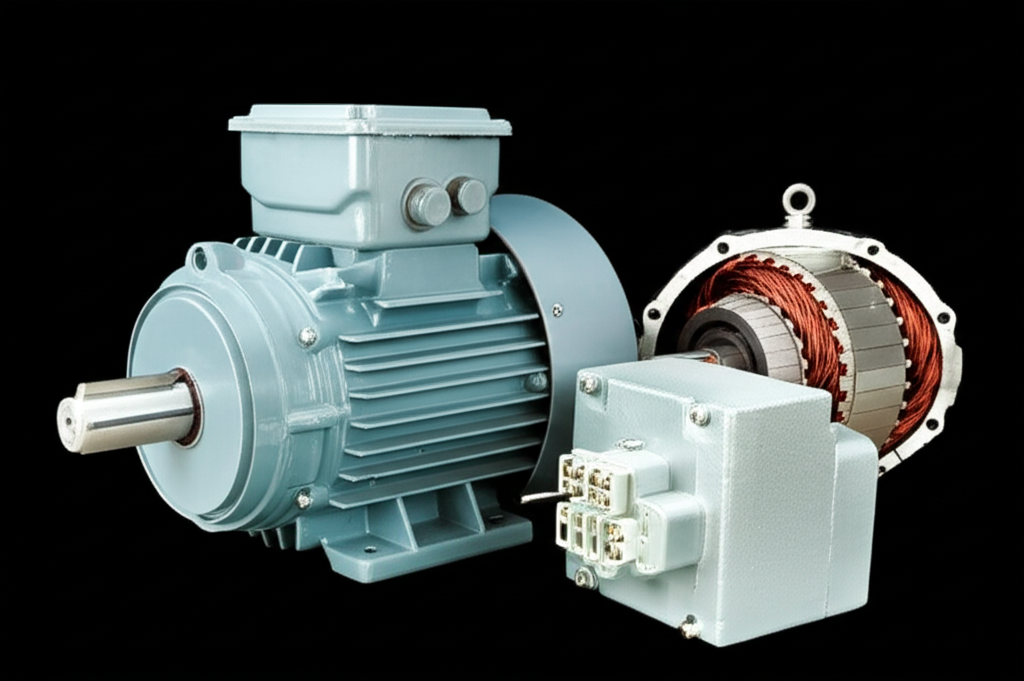

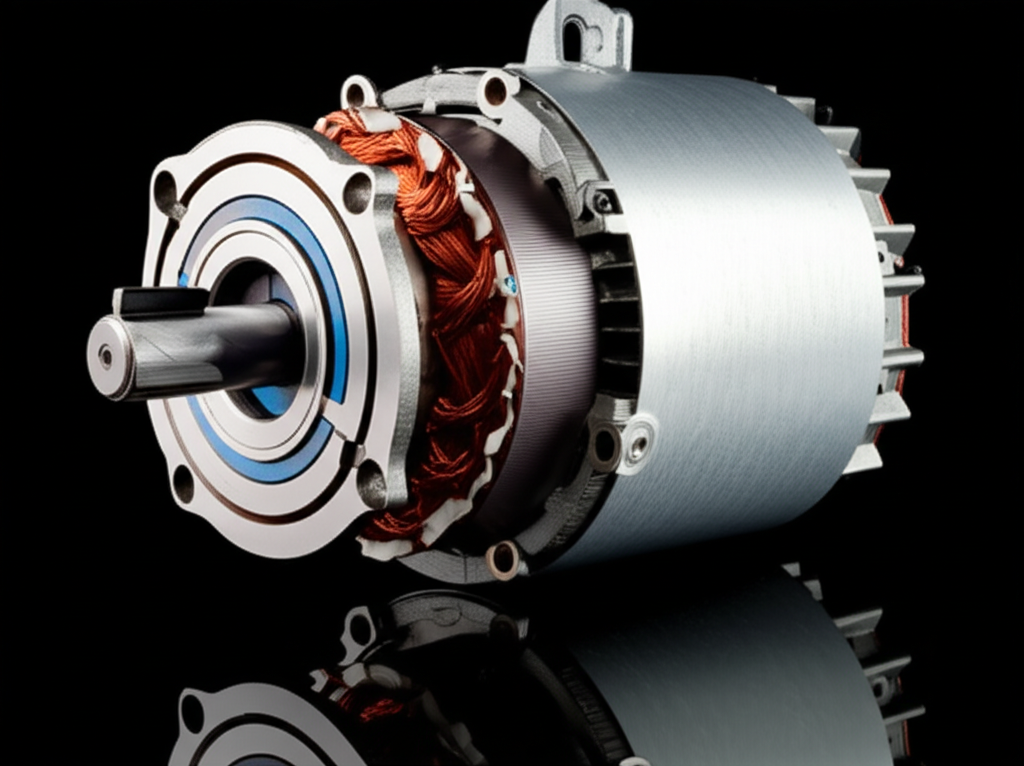

- Technology: While both are making EVs, their approaches are fundamentally different. Tesla’s vehicle architecture is built around a central computer, like a smartphone on wheels. Ford is adapting its proven manufacturing prowess to new electric platforms. They are making huge strides in engineering, but their core design philosophy, from the chassis to the individual motor core laminations, comes from a different school of thought.

Regulatory & Antitrust Hurdles

Let’s imagine for a second they overcome the financial and cultural problems. The deal would then face a massive wall of government scrutiny. Regulators in the United States and Europe would have serious antitrust concerns about two of the world’s largest automakers merging. The consolidation would reduce competition, potentially impacting consumer prices and innovation. Gaining approval would be a long, brutal, and uncertain process.

The Ford Family’s Control

Here’s a crucial fact that many people overlook: you can’t just buy Ford on the open market. The Ford family, descendants of Henry Ford, retains significant control over the company through a special class of stock (Class B shares). These shares give them disproportionate voting power. No hostile takeover of Ford Motor Company could succeed without the family’s blessing. And everything they’ve said and done shows they are committed to steering the company into the future themselves, not handing over the keys.

Musk’s Existing Portfolio

Finally, look at what’s already on Elon Musk’s plate. He is actively running Tesla, SpaceX, The Boring Company, Neuralink, and X. Each one is a demanding, world-changing venture. The idea that he has the bandwidth to take on the gargantuan task of integrating and transforming a legacy automaker like Ford seems highly unlikely. He’s a visionary, but even he has limits.

The Real Relationship Between Tesla and Ford

So, if they aren’t merging, what is the relationship between Tesla and Ford? In my view, it’s one of intense competition fueling mutual progress, with a surprising dash of collaboration.

They are, without a doubt, fierce competitors in the EV race. The Tesla Model Y competes with the Mustang Mach-E. The revolutionary Cybertruck is in a head-to-head battle with the iconic F-150 Lightning. This competition is great for consumers. It pushes both companies to innovate faster, improve battery technology, and lower prices.

However, we’ve recently seen a fascinating example of collaboration. Ford, along with General Motors and several other automakers, made the landmark decision to adopt Tesla’s charging plug design, now called the North American Charging Standard (NACS). This was a pragmatic move that benefits everyone. Ford drivers will get access to Tesla’s robust Supercharger network, and it helps standardize charging infrastructure, which is a win for the entire EV industry. This is a sign of a maturing market where rivals can cooperate for the common good without needing to merge. They are partners in building the future of EV infrastructure, not in the boardroom.

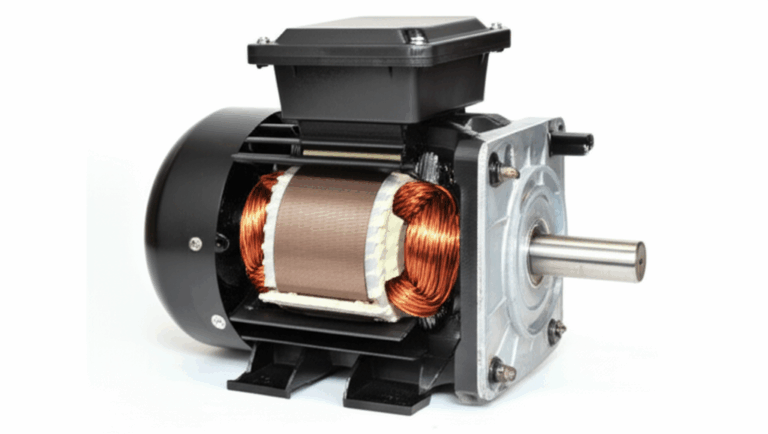

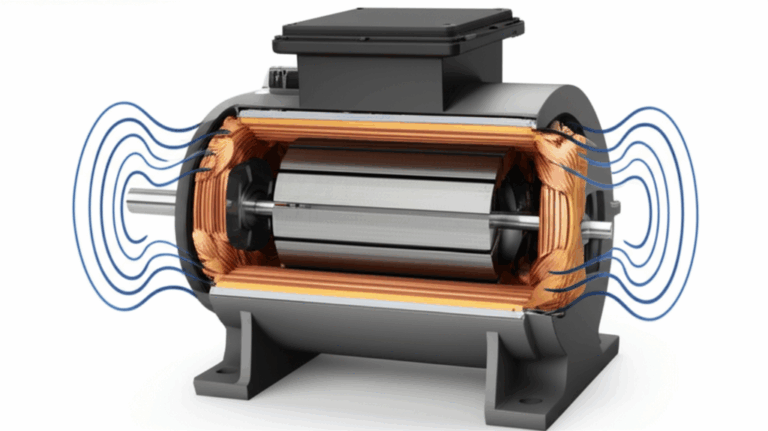

The core technology of EVs, particularly the electric motor, is an area of intense innovation. The efficiency and power of these motors depend on the precise design of their internal components. The relationship between the stationary and moving parts, often referred to as the stator and rotor, is where much of the engineering magic happens. Both companies are pushing the boundaries of what’s possible here, even if they share a charging standard.

Hypothetical Impact: If a Merger Were to Happen (Pure Speculation)

Alright, let’s have a little fun and step into an alternate reality where this deal actually happens. What would it look like?

It would be, in a word, chaotic. The merger would create the world’s most valuable and dominant automotive company overnight. The combined entity would have Tesla’s unmatched EV technology and software prowess alongside Ford’s global manufacturing scale and iconic brands.

- Potential Upsides: You could theoretically see a Ford F-150 with Tesla’s Autopilot software or a Mustang powered by Tesla’s battery tech. The synergies could be incredible, accelerating the EV transition by years. The new company could leverage Ford’s existing dealer network for service and delivery, solving one of Tesla’s biggest logistical headaches.

- Massive Downsides: More likely, you’d see organizational chaos. Tens of thousands of jobs would be redundant. Two vastly different engineering, manufacturing, and corporate cultures would clash. Would a Tesla-Ford use union labor or not? How would they merge their supply chains? Would the Ford brand even survive, or would it just become a manufacturing arm for Tesla?

In my experience, mergers of this magnitude are incredibly difficult to pull off successfully, even when the companies are culturally aligned. A Tesla-Ford merger would be the ultimate challenge, with a high probability of destroying immense value before creating any.

Conclusion: The Future of the Auto Industry Without a Tesla-Ford Merger

So, let’s come back to reality. The rumor of Elon Musk buying Ford is just that—a rumor. It’s an entertaining piece of speculation, but it’s not grounded in financial, strategic, or cultural reality.

What I see for the future is not a mega-merger but continued, fierce competition. Both Ford and Tesla are focused on their own paths to winning the electric age. Ford is leveraging its legacy and scale to build vehicles like the F-150 Lightning and investing billions in its own battery and motor production. They are focusing heavily on the quality of their EV components, knowing that the performance of a modern brushless DC motor, for example, is critically dependent on the quality of its bldc stator core.

Tesla will continue to push the boundaries of software, battery technology, and autonomous driving. The automotive landscape will be defined by this competition and by strategic partnerships, like the NACS charging deal. It’s a far more interesting and dynamic future than one dominated by a single, monolithic entity.

Frequently Asked Questions (FAQs)

Is Elon Musk interested in traditional car companies?

Based on everything he’s said and done, Musk’s interest isn’t in buying traditional car companies but in forcing them to change. He has stated that Tesla’s goal is to accelerate the advent of sustainable transport. By proving the viability and desirability of EVs, he has already forced companies like Ford, GM, and Volkswagen to invest billions in their own EV programs.

Who owns Ford Motor Company?

Ford is a publicly traded company, meaning it’s owned by its shareholders. However, the Ford family holds special Class B shares that give them 40% of the voting power, effectively giving them veto power over any major corporate decision, including a sale of the company.

What is Ford’s EV strategy?

Ford has committed over $50 billion through 2026 to develop and build electric vehicles and batteries. Their strategy involves electrifying their most iconic brands (Mustang, F-150, Transit van) and building a new EV manufacturing ecosystem, called BlueOval City in Tennessee, to scale production.

Are Tesla and Ford collaborating on anything?

Yes. The most significant collaboration is Ford’s decision to adopt Tesla’s NACS charging plug starting in 2025. This will give Ford EV owners access to Tesla’s Supercharger network, a major step toward standardizing charging infrastructure in North America.

Could any company realistically acquire Ford?

Acquiring Ford would be an immense challenge for any company due to its size, debt, and pension obligations. Most importantly, the Ford family’s controlling voting stake makes any hostile takeover virtually impossible. Any potential acquisition would have to be a friendly deal approved by the family and the Board of Directors.