What Is AIC Motor Club? My Hands-On Guide to Services, Benefits, Costs, and How It Compares

Table of Contents

- Introduction: Why I Care About Roadside Help

- What AIC Motor Club Is and Who It’s For

- What Services AIC Motor Club Typically Offers

- Roadside Assistance Services

- Travel and Lifestyle Benefits

- Automotive and Legal Support

- Membership Plans and Costs

- Types of Memberships

- Fees, Billing, and Discounts

- How to Join

- Benefits of Choosing AIC Motor Club

- AIC Motor Club vs. Competitors (AAA, Good Sam, AARP, MCA)

- Reviews, Ratings, and Reputation: What I Look For

- How I Maximize a Motor Club Membership

- Coverage, Service Limits, and Fine Print to Check

- EVs, Motorcycles, RVs, and Specialty Vehicles: What to Ask

- FAQs About AIC Motor Club

- Final Thought: Is AIC Motor Club Right for You?

Introduction: Why I Care About Roadside Help

I never thought much about roadside assistance until I had a blowout at 6 a.m. on the shoulder of a busy highway. Traffic roared past my hazard lights. I had a spare yet zero tools and zero confidence. My motor club saved the day. A truck arrived in minutes. The tech swapped the tire fast. I got to my meeting on time. That morning taught me a simple lesson. When things go south on the road, a dependable motor club feels like a lifeline.

Since then, I’ve tested a variety of plans for work and family. I compare towing limits. I check reimbursement rules. I read the fine print. So when someone asks “What is AIC Motor Club?” I approach it with the same practical lens. What do you get? How much does it cost? Is it legit? Will it show up when you need help most?

What AIC Motor Club Is and Who It’s For

AIC Motor Club appears to be a motor club brand that offers roadside assistance and related benefits. It’s not as widely known as an AAA or Good Sam. That doesn’t make it bad or good. It simply means I can’t rely on broad national name recognition for assurance. When a brand sits in that “lesser-known” bucket, I double down on due diligence.

Who is a club like this for? In my experience, motor clubs prove valuable for:

- Daily commuters who can’t risk being late because of a dead battery or a flat tire.

- Families who want peace of mind on road trips.

- RV and motorcycle owners who need specialty coverage.

- Students or seniors who prefer a budget-friendly plan with simple support.

- Anyone driving an older car who wants to avoid sky-high tow bills.

At a minimum, any club worth your money should offer 24/7 dispatch, a reliable service network, and clear coverage terms.

What Services AIC Motor Club Typically Offers

I couldn’t verify AIC-specific service limits or costs from widely recognized public sources. That’s normal with smaller or regional clubs. So I use typical industry offerings to set expectations. Then I confirm the exact details on the official website or by calling customer service.

Roadside Assistance Services

Here’s what I expect from a motor club at different membership levels:

- Towing service: Towing to the nearest qualified repair shop or a preferred destination within a set mile limit. Plans often range from 5 miles on bare-bones tiers to 100 miles or more on premium tiers. Some premium plans advertise “unlimited” tows, though limits and rules usually apply.

- Flat tire changes: Installing your spare tire if the tire is damaged. If you don’t have a spare, you’ll often pay for a tow.

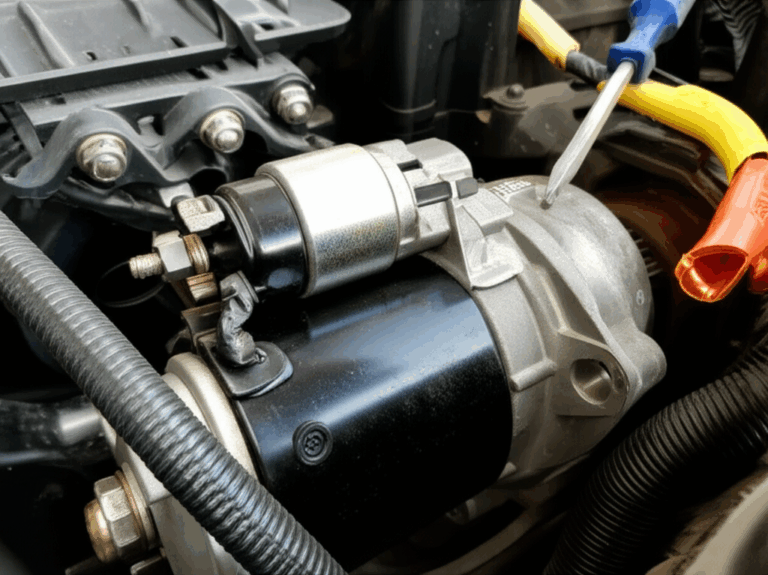

- Battery jump-start: A quick jump to get you moving. If the battery fails completely, the tow kicks in.

- Fuel delivery: Emergency fuel delivered to your location. The service is typically included, yet you pay for the fuel.

- Vehicle lockout service: A locksmith or lockout tech will help you regain entry. Some tiers include limited key replacement or reimbursement. Others don’t.

- Winching/extrication: A pull out of snow, mud, or a ditch. Single-vehicle winch is common. Complex recoveries can cost extra.

What matters most to me is how many service calls I get per year, whether tows are per incident or per membership year, and how far they’ll take me on a single call.

Travel and Lifestyle Benefits

Motor clubs often pair emergency road service with travel perks. I’ve seen:

- Hotel discounts and reservations support with chains like Marriott or Hilton through partner portals. The discount varies and may be similar to other public deals.

- Rental car discounts with companies like Enterprise or Hertz. I still compare with public promo codes since rates swing wildly.

- Trip planning and mapping support. Many clubs give digital route planners now. Printed trip books still pop up with older-school providers.

- Trip interruption reimbursement. If a breakdown strands you far from home, some plans reimburse lodging, meals, or transit up to a cap.

- Lost baggage or travel protection. These benefits tend to be modest unless you’re on a high-tier plan.

These perks can tip the scales for frequent travelers. For occasional drivers, the core roadside package usually drives the decision.

Automotive and Legal Support

This is where some clubs differentiate themselves:

- Auto repair discounts at approved shops. Savings show up on labor or parts. Some networks feel robust in cities and thin in rural regions.

- Diagnostic services through partner shops. These perks help narrow down issues before you sink money into repairs.

- Legal aid for traffic violations. I’ve seen bail bond benefits, attorney referral hotlines, and small legal fee reimbursements on some plans. Read the limits carefully.

- Vehicle service contract or extended warranty referrals. These are separate from roadside coverage. Evaluate the contract’s terms closely if you consider one.

- Personal accident insurance. Benefits are commonly small yet can help offset costs after an accident. Claims rules matter here.

Not every motor club offers the legal piece. When they do, I scrutinize the limits like a hawk.

Membership Plans and Costs

Membership structure tells you how the club thinks about value. I always compare what a plan promises to what I actually need.

Types of Memberships

Clubs often slice their plans into tiers and audiences:

- Individual plans: Coverage for one person or one vehicle depending on the club’s rules.

- Family plans: Coverage for spouses or household members. Kids often get covered if they live at home or attend school.

- Basic, Standard, and Premium tiers: Each step usually adds features or increases service limits. Premium may include longer towing distances, more calls per year, and better travel benefits.

- Corporate or business plans: Fleet-friendly options with flexible billing and coverage for multiple vehicles or drivers.

What matters is who or what is covered. Some plans cover the member in any car. Others cover only a specific vehicle’s VIN. That single detail can make or break your decision.

Fees, Billing, and Discounts

I commonly see:

- Annual or monthly payments. Annual can be cheaper over 12 months. Monthly feels easier on cash flow.

- Enrollment fees on some clubs. Many waive it during promos.

- Discount programs: military, senior, student, or multi-year. I always ask about available promos. The worst they can say is no.

As for cost, motor club memberships generally span from a bare-bones plan under $100 per year to a premium tier over $200 per year. The exact price for AIC Motor Club will come from their official site or sales team.

How to Join

Most clubs let you:

- Enroll online in minutes. You enter your name, address, email, phone, and payment method. If the plan covers specific vehicles, you’ll add the VIN or plate.

- Enroll by phone with a rep who can explain benefits and limits in plain language.

- Get a digital membership card in a mobile app. The app often provides one-tap roadside requests and real-time updates.

If AIC offers a mobile app, I’d install it on day one. You don’t want to hunt for a phone number at 2 a.m. in the rain.

Benefits of Choosing AIC Motor Club

Why pick AIC Motor Club over more famous alternatives? I ask myself a few questions:

- Peace of mind: Does the plan promise 24/7 dispatch with a solid network? I want quick response times and reliable service providers.

- Cost savings: Could the plan save me from a several-hundred-dollar tow? Could travel discounts offset part of the annual fee? Real examples help. A single 50-mile tow can cost more than a basic annual membership in many markets.

- Convenience and accessibility: Do I get a mobile app, a digital card, and text updates? Can I track the truck’s ETA? Does the club offer bilingual support? Convenience adds up during stressful moments.

- Coverage for specialty vehicles: If I own an RV or motorcycle, I confirm whether AIC covers those vehicles. Specialty coverage usually sits on higher tiers.

- Transparent rules: The best clubs show tow limits, the number of calls allowed per year, and what counts as a call. I want clear “yes or no” answers to basic scenarios.

If AIC checks these boxes with competitive pricing and clear terms, it deserves a spot on your short list.

AIC Motor Club vs. Competitors (AAA, Good Sam, AARP, MCA)

I don’t compare clubs by brand recognition alone. I stack them up on tangible factors:

- Cost comparison: Put AIC’s price next to AAA, Good Sam Roadside Assistance, AARP Roadside Assistance, and Motor Club of America. Look at total annual cost for the same coverage level.

- Service limits: Compare towing distances, number of calls per membership year, and whether tows reset per call. Also check lockout, fuel delivery, and flat tire coverage.

- Breadth of travel benefits: Some clubs bundle hotel, rental car, and trip interruption benefits with mid-tier or premium plans. Others keep it minimal. Decide if you’ll use those perks.

- Customer service reputation: Read ratings on the Better Business Bureau and Trustpilot. Search for common complaints and pay attention to responses. A fast, professional reply builds confidence.

- Geographic coverage: AAA is a national network through local clubs. Good Sam leans into RV coverage. Smaller clubs can be regional. Find out where AIC provides the strongest service.

Who is AIC best for? If their sweet spot matches your usage pattern, you might save money without sacrificing reliability. If you need nationwide coverage with long tow distances on every trip, a big national player may suit you better.

Reviews, Ratings, and Reputation: What I Look For

A name you’ve never heard before can be a hidden gem or a headache. I do this:

- BBB profile: I look for accreditation status, customer ratings, and how they resolve complaints. I read the most recent complaints to spot trends.

- Trustpilot and Google reviews: I search for recurring themes. Tow response time, denial of claims, and billing issues rank as common friction areas.

- Social proof: Forums and Facebook groups often share raw experiences. I treat anecdotes with care yet patterns tell a story.

- Terms transparency: A clear benefits guide builds trust. Opaque terms worry me.

- Cancellation and refund policy: I check the policy before I buy. If something goes sideways, I want a fair path out.

How I Maximize a Motor Club Membership

You can squeeze more value out of your membership with a few simple habits:

- Read the benefits guide: I know it sounds boring. It saves money later. I mark the pages that cover towing distance, winch limits, and what’s excluded.

- Use the mobile app: It’s faster than calling in many cities. You also get updates that reduce stress.

- Keep your membership info handy: I keep a photo of my card in my phone’s Notes app. I also save the emergency number as a favorite.

- Practice clear requests: When you call, be concise. Location, vehicle description, problem summary, and whether you have a spare tire. Good info gets you the right truck faster.

- Save receipts for reimbursement: If you pay out of pocket, some plans reimburse. Follow the exact claim steps. Deadlines matter.

- Leverage discounts: Hotel or rental car discounts might offset part of your membership cost during one weekend trip.

Coverage, Service Limits, and Fine Print to Check

I treat the fine print like a checklist. Before I sign up, I want the answers to these questions:

- What’s the towing distance on my tier? Does it reset per call? Are there caps per year?

- How many service calls do I get per membership year? What counts as a “call”?

- Are RVs, motorcycles, or trailers covered? If yes, on which plan?

- Does lockout include key replacement or just access?

- How does fuel delivery work? Do I pay for the fuel at market rate?

- Are there exclusions I should know? Some clubs exclude service on unpaved roads, commercial vehicles, or areas deemed unsafe.

- What’s the reimbursement policy if I can’t wait for a truck? Do I need pre-approval?

- How do cancellations and refunds work? Is there a cooling-off period?

Strong clubs make these answers easy to find. That’s a sign of trustworthiness.

EVs, Motorcycles, RVs, and Specialty Vehicles: What to Ask

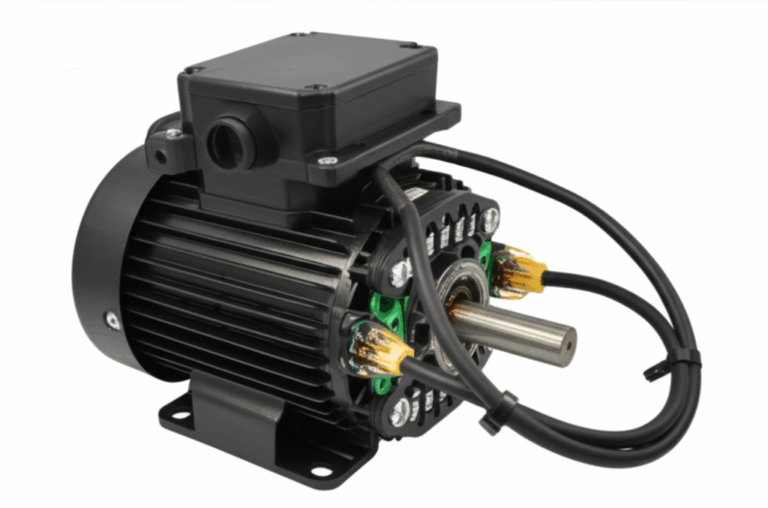

Electric vehicles change the roadside equation. No gas. Much heavier. Different failure modes. If you drive an EV, ask:

- Does the plan include EV-specific tows to charging stations?

- Are there flatbed requirements? Many EVs require flatbed towing to protect the drivetrain.

- Do they support out-of-charge situations with mobile charging? Few clubs do yet some markets offer it.

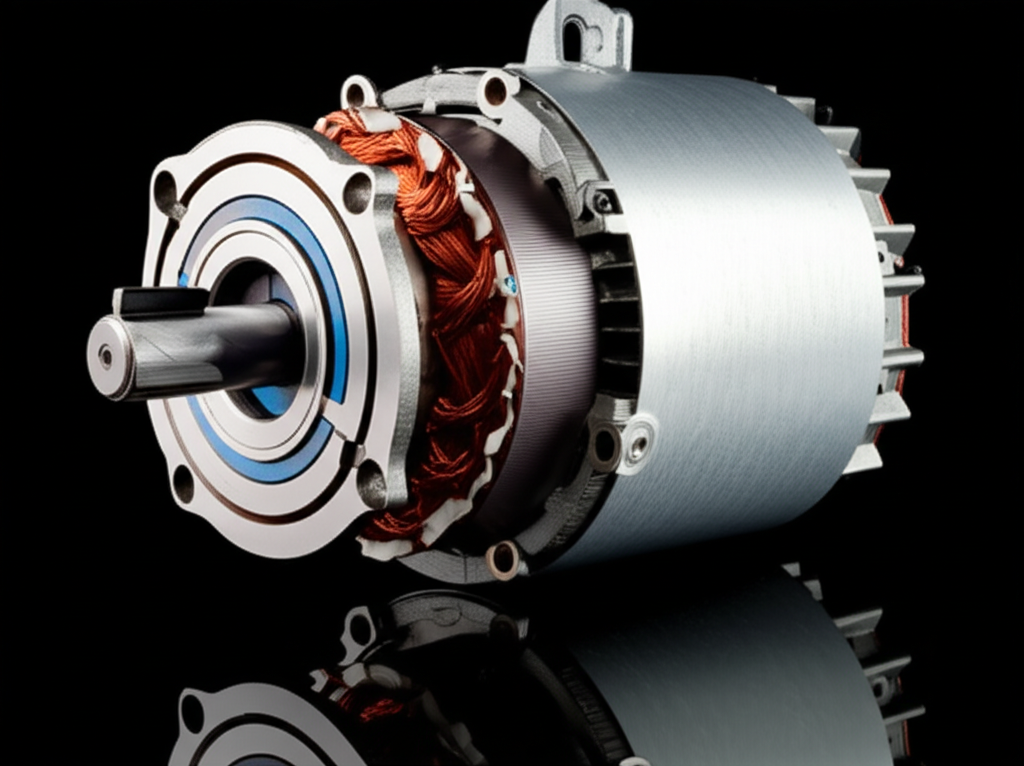

Curious about the mechanics behind EV motors? It can help you talk to roadside providers more confidently. I recommend quick primers on stator and rotor fundamentals and a refresher on the motor principle to understand how electric motors produce torque. If you’re diagnosing noises or performance issues, a guide to common motor problems provides helpful context, especially when you’re deciding between a tow and a quick on-site check.

For motorcycles and RVs, I ask:

- Do you offer motorcycle-specific towing equipment?

- What are the RV length and weight limits?

- Do you cover trailers and fifth wheels? Under what conditions?

- Are there separate call limits for specialty vehicles?

Specialty coverage tends to live on premium tiers. If you own these vehicles, don’t assume they’re covered under basic plans.

FAQs About AIC Motor Club

Here are the questions I hear most, along with how I’d approach them for AIC.

- How quickly does AIC Motor Club respond to calls?

Response time depends on your location, traffic, weather, and the strength of the local service network. In cities during normal hours, I’ve often seen 30–60 minutes from large providers. Rural areas or storms can push it longer. For AIC, I’d check their average ETA claims and read recent reviews in your area.

- Can I use my benefits for any vehicle?

Some clubs cover the member in any vehicle. Others cover only the vehicle listed on your account. Ask AIC whether coverage follows the member or the vehicle. If you drive or ride in multiple cars, that detail matters.

- How do I cancel my membership?

Cancellation policies vary. Look for a clear policy on the AIC website or ask by phone. Note any refund windows or pro-rated refunds for unused months.

- Is there an age limit for membership?

Most clubs do not set age limits. They may offer senior discounts or student plans. Confirm AIC’s eligibility rules.

- Does AIC Motor Club offer international coverage?

Many clubs focus on national coverage with limited cross-border benefits. If you travel internationally, ask about partner networks, reimbursement rules, and what happens if you break down abroad.

- Is AIC Motor Club legitimate?

I look for a working official website, clear terms, a reachable customer service number, and verifiable business details. I also check BBB and Trustpilot for a reputation snapshot. If those boxes get checked, I feel more confident.

- What does AIC Motor Club cost?

Pricing shifts by plan, region, and promotions. Expect a range similar to other clubs. The exact number lives on the official AIC site or with their sales team.

- Does AIC Motor Club include bail bond benefits or legal support?

Some clubs do. Ask AIC if they provide attorney referrals, limited bail bond assistance, or traffic ticket guidance. If they do, get the limits in writing.

- How does reimbursement work if I get my own tow?

Reimbursement usually requires pre-approval unless you face unsafe conditions or lack of available providers. Save itemized receipts. Submit claims within the stated deadline.

- What travel discounts can I expect?

Typical discounts include hotel and rental car savings. Compare AIC’s travel portal rates with public rates before booking. Sometimes your membership wins. Sometimes a promo code elsewhere beats it.

Real-World Scenarios I Use to Test a Plan

I run sample scenarios in my head before I sign:

- “My car dies 48 miles from home at 10 p.m. on a Sunday.” Will the tow be covered to my home shop without extra charges?

- “I’m locked out without a spare key.” Does the plan cover lockout only, or does it help with key programming or replacement?

- “I blow a tire without a spare.” Will they tow me to a tire shop that’s open? If everything is closed, will they tow to a safe location and return later?

- “I’m traveling with kids in the back and a dog in the crate.” Do they provide status updates and accurate ETAs so I can manage the chaos?

Plans that handle these scenarios clearly tend to be the ones I trust.

What to Ask AIC Motor Club Directly

When I evaluate a smaller or less-known club, I call with a short list of direct questions:

- Are tows per incident or per membership year?

- How many service calls do I get annually on my tier?

- What’s your average response time in my ZIP code?

- Do you contract with local providers or operate your own fleet?

- What are the exact exclusions for off-road areas, commercial use, or unsafe environments?

- Do you require pre-authorization for reimbursement?

- How do cancellations and refunds work?

I take notes during the call. Clear, friendly answers go a long way.

How to Compare AIC Motor Club to Your Needs

Start with your driving profile:

- Mileage and usage: Daily commuter or weekend driver?

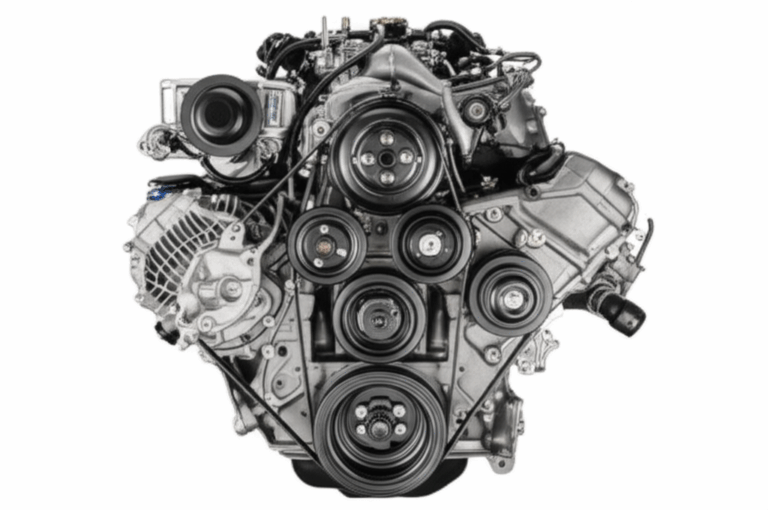

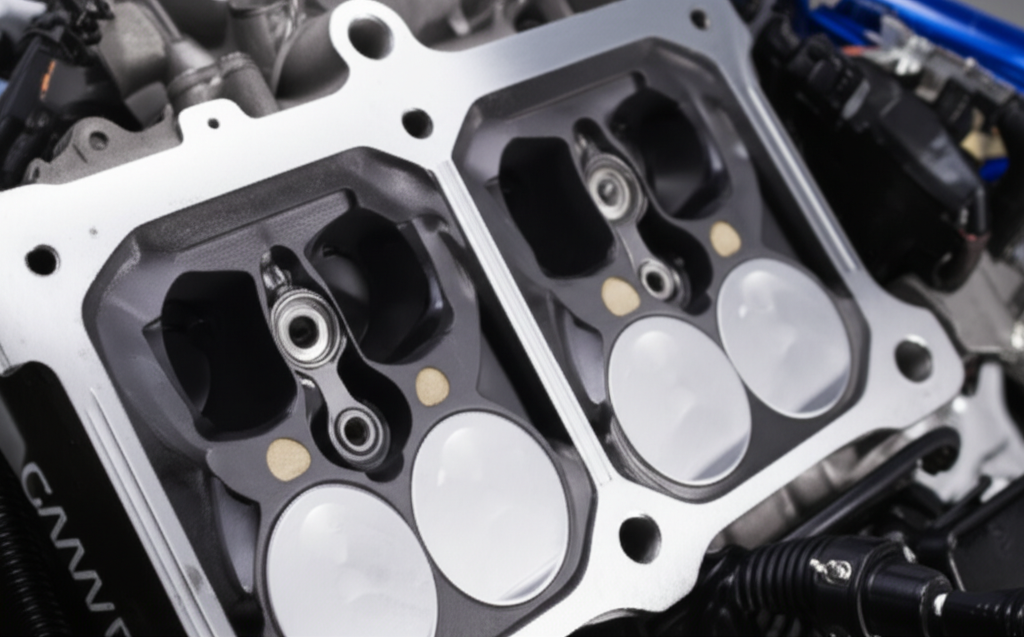

- Vehicle mix: ICE, EV, RV, motorcycle, or trailer?

- Travel habits: Long road trips or mostly local?

- Risk tolerance: Will you pay extra for a premium tier to avoid tow surprises?

Then set your priorities:

- Towing distance and number of calls per year.

- Lockout, flat tire, fuel, and winching coverage.

- Travel benefits like hotel and rental car discounts.

- Legal or accident coverage extras.

Finally, check the receipts:

- Price for the exact tier you need.

- Verified reviews in your region.

- Transparent terms. No mystery clauses.

Case Study: When a “Mid-Tier” Plan Saved Me Hundreds

A few months ago, I helped a friend pick a mid-tier plan before a long drive across two states. Not AIC specifically, yet the features were similar to what many motor clubs advertise. We chose a plan with 100 miles of towing and trip interruption coverage. Sure enough, the car broke down outside a small town on a Sunday night.

Here’s what happened next:

- The dispatch found a local tow within 45 minutes.

- The plan covered the tow to a trusted shop back near home, which sat about 80 miles away.

- The plan reimbursed a night in a hotel and basic meals under trip interruption benefits.

We did two things right. We read the terms. We picked a tier that matched the driving plan. That decision saved real money.

When a Basic Plan Makes Sense

On the flip side, I don’t always push the premium tier. If you drive mostly in-town, your car is newer, and you don’t plan road trips, a basic plan can do the trick. You’ll likely get a short tow, a few service calls per year, and the core features like lockout and jump-starts. Those basics solve most urban problems.

How to Avoid Buyer’s Remorse

A few pitfalls I see often:

- Buying the cheapest plan and then needing a long tow. The per-mile overage adds up fast.

- Assuming motorcycles or RVs are covered on basic tiers. Specialty rigs often require specialty plans.

- Ignoring family coverage needs. One extra driver might push you into a family plan that saves money overall.

- Not reading reimbursement rules. Success lives in the fine print.

Final Checklist Before You Join AIC Motor Club

- Confirm the membership type covers your vehicle and your drivers.

- Verify towing distances and annual call limits on your tier.

- Ask about response times in your area.

- Check hotel and rental car benefits if you plan to travel.

- Read the cancellation and refund policy.

- Compare AIC pricing to AAA, Good Sam, AARP, and MCA for similar tiers.

- Search BBB and Trustpilot for recent reviews in your region.

- Save the customer service number in your phone.

FAQs About AIC Motor Club (Quick Recap)

- Response times: Vary by location and traffic. Ask for local averages.

- Vehicle eligibility: Some plans cover you, not the car. Verify which applies.

- Cancellation: Policies differ. Get the details before you enroll.

- Age limits: Rarely an issue. Discounts may apply for seniors or students.

- International coverage: Often limited. Confirm before you travel abroad.

Final Thought: Is AIC Motor Club Right for You?

Here’s my take. If AIC Motor Club offers the coverage you need at a fair price with clear terms and a reliable service network, it’s worth a serious look. The name on the card matters less than how the plan performs when your day goes sideways. Do your homework. Check the towing distance and call limits. Read the benefits guide. Scan reviews in your area. Then choose with confidence.

When you’re ready, visit the official AIC Motor Club website or call their customer service to confirm current offers and plan details. Ask every question that matters to you. You’re not just buying a membership. You’re buying peace of mind when the unexpected happens on the road.